Controversial INX token launch triggers derision, fear and introspection

Does Bitcoin have a wholesome skepticism, or an above-lively immune process?

Various notable figures in the Bitcoin maximalist community, a team which essentially life by the policies “thou shalt worship no other coins before Bitcoin” and “graven idols of BTC are inspired for marketing needs”, have popped some monocles by endorsing the INX token sale.

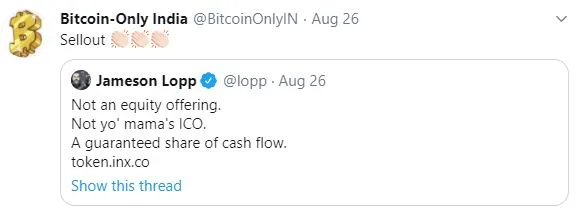

Not an equity supplying.

Not yo’ mama’s ICO.

A assured share of income flow.https://t.co/dllKboGwT2— Jameson Lopp (@lopp) August 25, 2020

Not only does this violate the “no other god before Bitcoin” rule, but since the INX token is based mostly on Ethereum – 1 of the most despised foes of Bitcoin maximalists – endorsing it also qualifies as adultery.

And as long as we’re complaining, the phrase “assured share of income flow” feel a small “bearing phony witness-ey”, legally speaking.

So far, most commentators have located small cause to covet this token.

Derision

The INX token is an exchange token for the INX security token platform. The platform is at present nonexistent, but is sooner or later meant to serve as a regulated location for trading digital securities.

The most strongly-touted one of a kind offering stage of the INX exchange is that it will be lawful and regulated, just like other substantial, set up securities exchanges. But hey, as long as Coinbase isn’t going to start off handling security tokens it could however uncover a area of interest.

The token is meant to allow holders discounts on trading charges if they finish up making use of the platform, as perfectly as forty{cbf6da10fac2230370cea9448ed9872290737d25c88b8c8db3eefaf8c399e33d} of the trading charges created, issue to transform by the organization board of directors. All governance legal rights and the other sixty{cbf6da10fac2230370cea9448ed9872290737d25c88b8c8db3eefaf8c399e33d} of gains continue to be with equity holders.

The general public token sale selling price is US$.ninety per token, although in accordance to the INX SEC registration document, advisors like Samson Mow and Jameson Lopp have been supplied the solution of acquiring tokens at $.01, for an straightforward 90x obtain if matters get the job done out. Meanwhile Monero’s Riccardo Spagni and Litecoin’s Charlie Lee, who are also investing in this enterprise, appear to have just absent for the equity fairly than the token.

The INX ICO security token supplying aims to unleash 130 million tokens on the general public. At ninety cents just about every, that is a $117 million concentrate on. For comparison, the Binance ICO was $fifteen million. Judging from what seems like the token sale agreement, the INX token sale has located about 200 purchasers at the time of composing.

The again-of-napkin math on this token sale is just a frowny deal with.

Concern

When the Bitcoin community noticed what grew to become of its prophets, it was outraged, and said “Wastrels! You have turned Satoshi’s home of prayer into a den of burglars in a way that isn’t going to monetarily profit us!”

Other disciples nervous aloud whether this was a signal of the finish situations.

“I am just not confident I can have confidence in them just after this,” said 1 Bitcoin lover when anxiously fidgeting with the hem of their “Really don’t have confidence in, verify” t-shirt.

“I can’t feel INX is making use of Ethereum,” an additional complained. “All people understands Ethereum is centralised since its superstar whales and developers have too considerably impact.”

As the furor grew, the prophets’ social media reputations took a beating.

Viewpoint: Introspection

Few appeared much more shocked by the outcry than the prophets on their own. Mow pointed out that they’d already atoned when the news to start with broke last yr, when Lopp questioned whether probably some of that Bitcoin maximalism he’d invested yrs fomenting might be a small disconnected with reality. Some commentators prompt that this was a little bit out of character for him.

Though it really is tempting to write this complete incident off as just 1 much more popcorn break in the historical past of Bitcoin, it really is possibly value ruminating on what this suggests about difficulties forward for decentralised governance.

This 7 days we noticed the broader Bitcoin community rally alongside one another in an hard work to expel the unbelievers and sustain the purity of Bitcoin, like an immune process rallying its antibodies. However, the normalisation of Bitcoin maximalism looks to have established an overactive immune process which will struggle off all perceived invaders, like many probable purchasers.

There is certainly a cause many Bitcoin fanatics list maximalism as the quantity 1 menace to the coin’s long term.

Bitcoin is a specific circumstance while. More than the yrs schisms like Bitcoin Income eliminated users who dreamt of Bitcoin being digital forex fairly than digital gold, when the ascent of Ethereum and other initiatives has shaved absent any one who’s intrigued in crypto for motives other than hoarding digital gold bars.

The finish outcome is incredibly uniform and dogmatic immune process that may perhaps not be ready to adapt to the difficulties Bitcoin will deal with in the long term, these as conversations of alternate block benefits.

Bitcoin semi-unknowingly invested yrs honing itself to a maximalist edge, and with a complete new slew of governance difficulties rising in the DeFi room, it really is a fantastic time to discover from Bitcoin’s problems.

Any community which relies intensely on purity tests (i.e faith) is sooner or later cannibalized as a minority is forced to radicalize above time.

My preferred cultural basis: truth of the matter in search of, open mindedness, empathy, optimism, focus on developing v. critiquing (doers > haters)

— Arjun Balaji (@arjunblj) August 26, 2020

Also view

Disclosure: The writer retains cryptocurrencies like Backlink at the time of composing

Disclaimer:

This data really should not be interpreted as an endorsement of cryptocurrency or any distinct provider,

assistance or supplying. It is not a advice to trade. Cryptocurrencies are speculative, complex and

entail important threats – they are very unstable and sensitive to secondary action. General performance

is unpredictable and previous general performance is no assurance of long term general performance. Think about your personal

circumstances, and acquire your personal guidance, before relying on this data. You really should also verify

the mother nature of any item or assistance (like its lawful position and related regulatory needs)

and consult the related Regulators’ web-sites before making any choice. Finder, or the writer, may perhaps

have holdings in the cryptocurrencies reviewed.

Newest cryptocurrency news

Image: Shutterstock